My state Utah has no such requirement. P2P microloan for poor people.

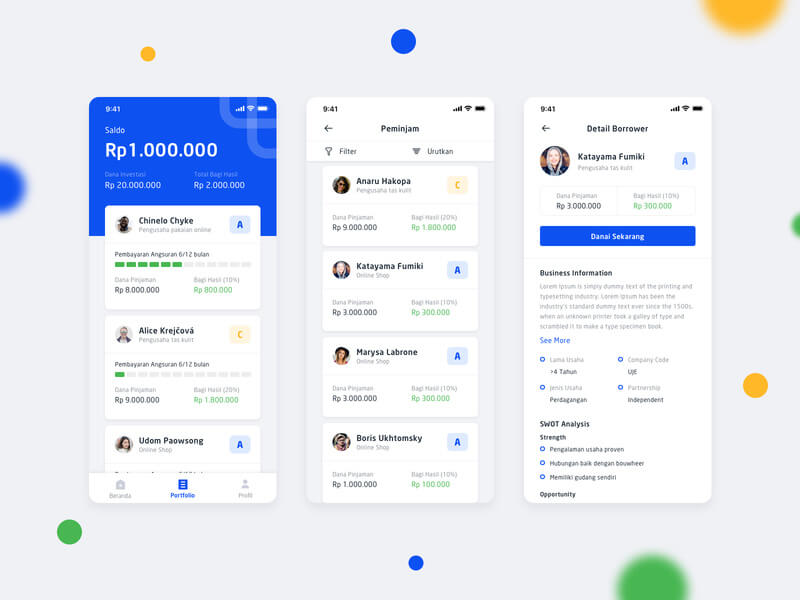

How To Develop A Peer To Peer Loan Lending App

Ultimately we believe that P2P lending provides the ability for everyone to materialize a second flow of income.

P2p lending without income proof. Our duty now is to get the most out of it to generate an automatic income from it lowering the risk involved to the minimum. P2P for unemployed people without proof of income. All loans are in.

Similar to how Bitcoin is enabled by. Prefer to watch a video. P2P lending for Indian individual.

300 FastInvest is a P2P Lending platform with its headquarters in the UK. Just as all online things a P2P platform is fast convenient and simple to use. Some states do not allow P2P while others do but they have income requirements.

According to FORBES the Peer to Peer lending P2P market have been growing rapidly last couple of years and is a great passive income source for investors. Get personal loans at rates starting from 1199 per annum. Borrowing through a peer-to-peer lending platform is quick hassle-free collateral free and affordable.

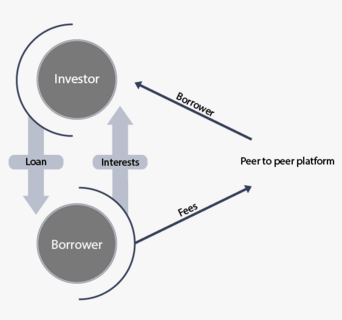

For those who arent familiar P2P lending is the idea that a retail investor can fund loans made to borrowers removing the layer of a financial institution. Even after using Resend if you do not receive the OTP kindly contact us at. Our risk assessment model ensures that you get the best offer as per your risk-profile.

This help lender to manage their cash-flow by investing. LP2P for Indian startup. I think most readers of Sams website will make the income cut youll just have to live in a state that allows you.

No organization can carry on the business of P2P lending without obtaining a certificate of registration from the Reserve Bank. In this guide well explain what P2P lending is and the range of P2P lending business models available for investors like you to invest in. The return on P2P lending in a way is fix and visible to plan ones future cash outflow.

By connecting borrowers directly with the lenders it removes the intermediary costs and. P2P investments also have low volatility and a low correlation compared to the stock market. The process is paperless with disbursement within 24 hours.

Usually its 70000 a year or more in income. Prerequisites To P2P Lending. Chat tool - please see the icon next to you on the screen at extreme right corner.

Peer-to-Peer lending is concept wherein the p2p lending companies provide an online platform wherein individual lenders and borrowers can come together to lend and borrow. P2P loans are an income investment because once an investor opens an account and chooses to participate in a loan principal and interest payments less fees charged by the platform are deposited into the investors account wallet on a monthly basis. Peer-to-peer borrowing from entrepreneurs and business people.

Quick and hassle-free personal loan. P2P loan for disabled. No need to wait in long queues at the bank.

Lending money on P2P platforms is affordable. The office and company is located in Prague Czech Republic and exclusively offers financing to Czech residents. Compare our experiences to yours learn from our mistakes and take a greater step to financial independence.

If youre interested in P2P Lending you have come to the right place. For the first time in history we can function as a bank assimilating an estimated part of the risk while getting adequately repaid. Interest rates are at all-time lows and the normal historically safe investments are not as good.

P2P peer-to-peer lending is a popular way to earn money online by investing in loans that are borrowed by people or businesses. Lendbox is an RBI-certified NBFC-P2P. Peer-to-Peer lending is the latest financial tool which allows borrowers of reasonable credit standing to avail loans at relatively lower rates than those offered by banks financial institutions.

Peer to peer lending P2P is a form of crowd-funding used to raise loans which are paid back with interest. The first thing to look at when you get started with peer to peer lending is the prerequisites. Peer-to-peer lending for elderly senior retired people.

Yes P2P Lending is a legal business regulated by the Reserve Bank of India. Peer-to-peer lending for Indian farmer. P2P Lending Helps People Gain Financial Independence.

If you are unfamiliar with peer to peer lending it is a way as a consumer to get a personal loan outside of a bank. Its a 4-step application process and requires minimal documents. Bankerat was founded in 2010 by Roman Kakos as a Czech company.

Be sure to understand the requirements in your state before considering this as an income. Peer to Peer lending or P2P is an alternative investment outside of the stock market to invest your money. Secured and completely digitised process.

But originated from Latvia that was founded in 2015. You can register yourself as a lender or a borrower and find other individuals to lend to or borrow from. Theres some qualifications to use peer to peer lending such as being in a state that allows it and having a certain level of verified income in different states.

Individual investors provide the funds for these loans. The platform offers financing to any purpose and with different safety depending on what kind of proof or collateral the borrower can give from loans without any proof or proof of income to real estate backed loans. It can be defined as the use of an online platform that matches peer lenders with borrowers in order to provide unsecured loans.

They provide access to consumer loans that are covered by a 100 Buyback Guarantee. Apply online for personal loans from anywhere at any time and get your loan application processed within a few days. Fast Invest P2P Lending Platform Initial Investment.

Https Businessperspectives Org Journals Task Callelement Format Raw Item Id 7985 Element E46cdb75 Ca7e 4c69 97ee 741acaab6046 Method Download Args 0 0

How Mintos Works Ultimate Guide To Start With Mintos P2p Lending By True From Revenueland Issuu

How To Develop A Peer To Peer Loan Lending App

Mintos Review After 5 Years My 31 499 Experience 2021 Revenue Land

How To Develop A Peer To Peer Loan Lending App

How To Develop A Peer To Peer Loan Lending App

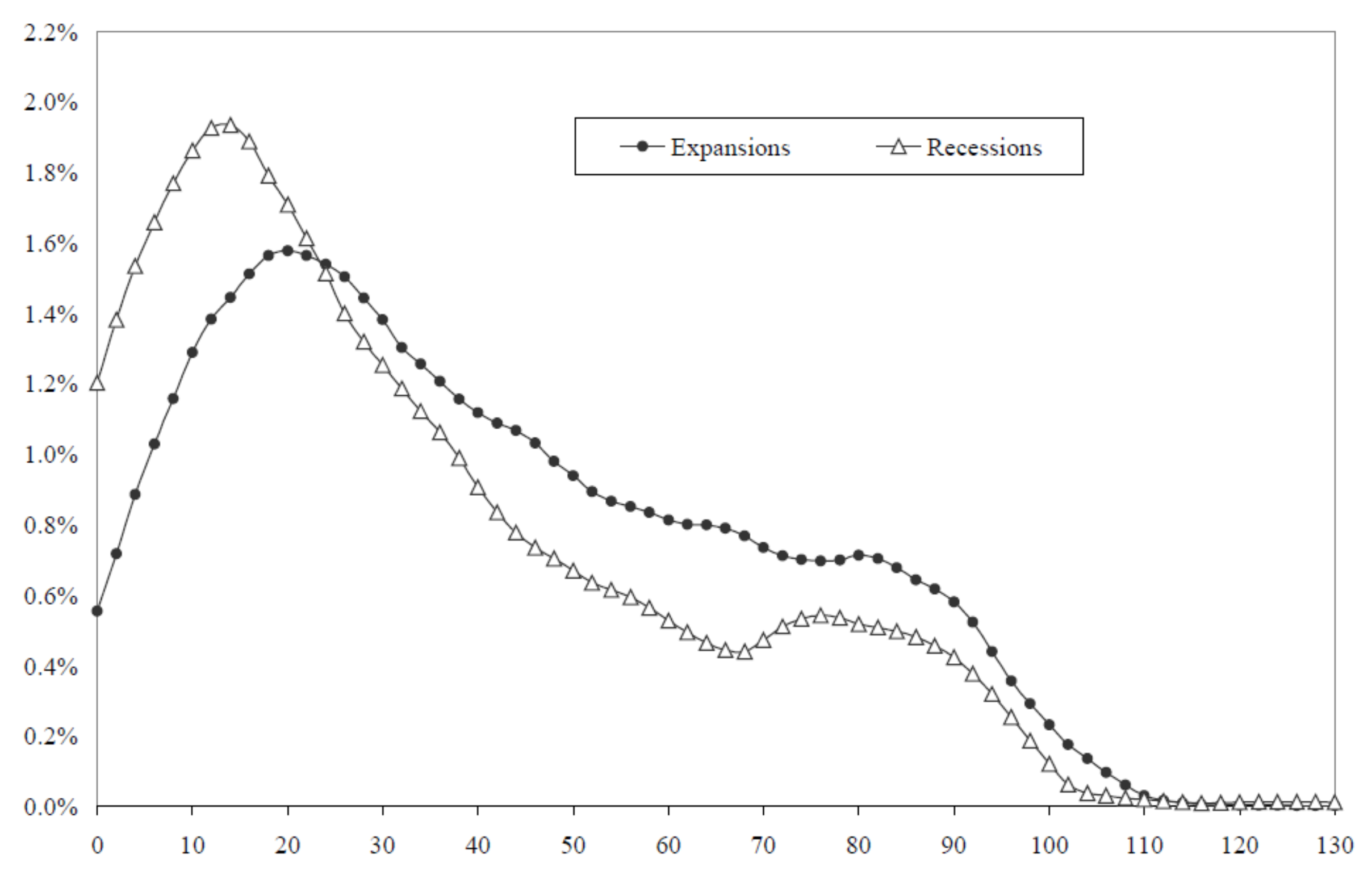

Sustainability Free Full Text P2p Network Lending Loss Given Default And Credit Risks Html

The Best P2p Sites To Invest In And Generate P2p Income

How To Conduct Due Diligence Of A P2p Platform

Economy Bridge Investment Through P2p Lending Platform

Full Article Why Does Regional Information Matter Evidence From Peer To Peer Lending

Passive Income From Peer To Peer Lending A Little Known Way To Make Money Online Revenue Land